A practical walkthrough on calculating the FEIE Standard Deduction

All About the Foreign Earned Earnings Exemption: Maximizing Your Criterion Deduction Advantages

The Foreign Earned Revenue Exemption (FEIE) provides a beneficial chance for U.S. citizens living abroad to reduce their tax obligation liabilities. Recognizing the eligibility requirements is vital for those seeking to take advantage of this exclusion. Additionally, declaring the common deduction can boost total tax obligation advantages. Managing this procedure entails cautious interest to information and a recognition of usual mistakes. Discovering these facets can provide quality and make best use of potential tax obligation benefits.

Understanding the Foreign Earned Earnings Exemption (FEIE)

The Foreign Earned Revenue Exemption (FEIE) allows U.S. citizens and resident aliens working abroad to leave out a portion of their foreign profits from government earnings tax obligation. This stipulation acts as a financial relief mechanism, allowing expatriates to maintain a larger share of their revenue earned in international countries. By minimizing gross income, the FEIE assists ease the concern of dual tax, as people might likewise undergo taxes in their host countries. The exclusion uses only to made income, that includes earnings, incomes, and expert charges, while passive income and investment gains do not certify. To profit from the FEIE, individuals should submit particular forms with the IRS, outlining their foreign profits and residency - FEIE Standard Deduction. Recognizing the subtleties of the FEIE can significantly influence monetary planning for united state citizens living overseas, making it important for migrants to stay educated concerning this advantageous tax arrangement

Qualification Criteria for the FEIE

To certify for the Foreign Earned Revenue Exclusion (FEIE), people need to fulfill details qualification requirements. This includes rewarding residency requirements, passing the physical existence examination, and developing a tax obligation home in a foreign nation. Each of these aspects plays a crucial role in establishing whether one can benefit from the exclusion.

Residency Requirements

Fulfilling the residency needs is essential for people seeking to get approved for the Foreign Earned Earnings Exemption (FEIE) To be eligible, taxpayers have to establish a bona fide residence in an international nation or countries for a continuous duration that usually extends an entire tax obligation year. This demand emphasizes the need of a much deeper link to the international area, relocating beyond mere physical presence. Individuals must show their intent to reside in the international nation and have developed their living situation there. Variables such as the length of keep, kind of housing, and neighborhood neighborhood participation are taken into consideration in establishing residency. Meeting these criteria is vital, as failure to do so might invalidate one from gaining from the FEIE.

Physical Visibility Examination

Establishing eligibility for the Foreign Earned Earnings Exclusion (FEIE) can also be achieved with the Physical Existence Examination, which calls for people to be literally existing in a foreign nation for a minimum of 330 full days during a successive 12-month period. This examination is helpful for those who might not fulfill the residency demand however still live abroad. The 330 days must be complete days, suggesting that any day spent in the USA does not count toward this total. It is necessary for people to preserve accurate records of their travel dates and locations to sustain their cases. Effectively passing this examination can substantially minimize taxable earnings and enhance financial outcomes for migrants.

Tax Home Place

Tax obligation home location plays an essential role in identifying eligibility for the Foreign Earned Income Exemption (FEIE) To certify, a private need to establish a tax obligation home in an international nation, which means their key workplace is outside the United States. This is distinctive from a simple house; the private must perform their job in the foreign nation while maintaining a considerable connection to it. The internal revenue service requires that the taxpayer can show the intent to remain in the foreign place for an extended period. In addition, keeping a home in the united state can complicate qualification, as it may recommend that the individual's true tax obligation home is still in the USA. Recognizing this standard is essential for making the most of FEIE advantages.

How to Assert the FEIE on Your Tax Obligation Return

Declaring the Foreign Earned Income Exemption (FEIE) on a tax obligation return calls for mindful interest to information and adherence to certain IRS guidelines. Taxpayers should first verify eligibility by meeting either the authentic home test or the physical visibility examination. When qualification is verified, they have to site web complete IRS Type 2555, which details international made income and appropriate information regarding their tax obligation home.

It is important to report all foreign revenue precisely and preserve appropriate documents to sustain insurance claims. Taxpayers need to likewise understand the optimal exemption restriction, which goes through yearly modifications by the internal revenue service. Declaring Type 2555 together with the annual tax return enables taxpayers to exclude a portion of their international profits from united state taxation. It is advisable to get in touch with a tax obligation specialist or IRS sources for updated info and support on the FEIE process, assuring compliance and maximization of possible advantages.

The Criterion Reduction: What You Required to Know

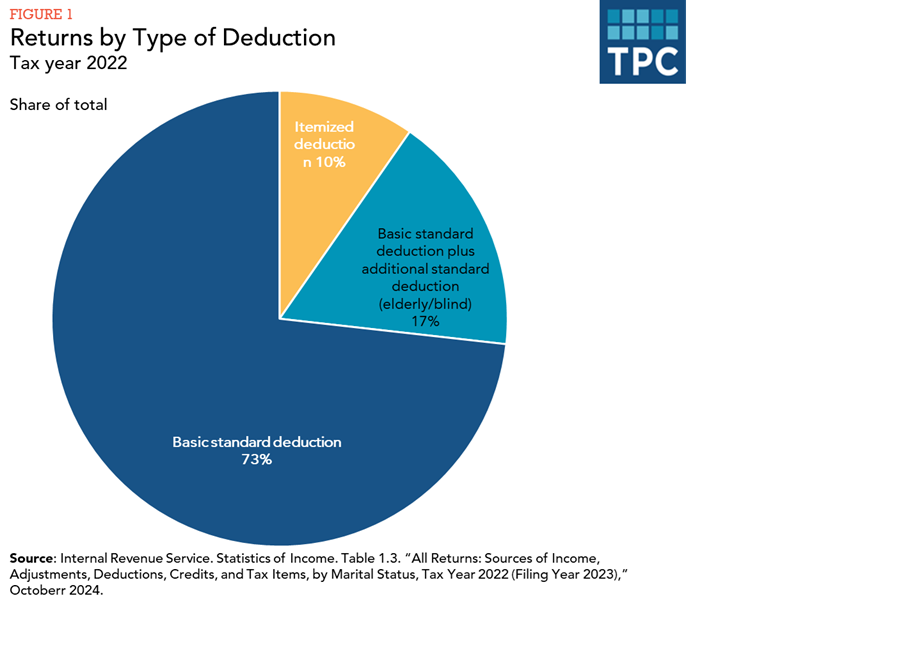

Just how does the basic reduction impact taxpayers' overall monetary situation? The conventional deduction works as a significant tax advantage, decreasing taxable revenue and possibly lowering tax obligation responsibilities. For the tax year 2023, the conventional deduction is established at $13,850 for solitary filers and $27,700 for married pairs filing check these guys out collectively. This deduction streamlines the declaring process, as taxpayers can select it as opposed to itemizing reductions, which calls for comprehensive record-keeping.

Taxpayers earning foreign income might still claim the standard deduction, gaining from decreased taxed income even while making use of the Foreign Earned Earnings Exclusion (FEIE) It is necessary to keep in mind that the typical deduction can not be combined with itemized deductions for the very same tax year - FEIE Standard Deduction. Understanding the standard deduction enables taxpayers to make enlightened decisions regarding their tax approaches, making the most of offered advantages while making sure compliance with IRS laws.

Techniques for Maximizing Your Deductions

Maximizing reductions under the Foreign Earned Income Exemption requires a clear understanding of earned earnings limitations and the benefits of asserting housing exclusions. In addition, utilizing Kind 2555 successfully can enhance the possibility for considerable tax financial savings. These methods can substantially affect the general tax obligation liability for expatriates.

Understand Gained Revenue Restrictions

While many migrants look for to decrease their tax obligation burden, comprehending the gained income limitations is essential for properly leveraging the Foreign Earned Earnings Exclusion. The Irs (IRS) establishes details thresholds that determine the maximum quantity of international made revenue eligible for exclusion. For the tax obligation year 2023, this restriction is $120,000 per certified individual. Exceeding this limit might cause taxes on the income above the limitation, decreasing the advantages of the exclusion. To maximize deductions, expatriates must maintain exact documents of their foreign gained revenue and evaluate their eligibility for the exclusion each year. Strategic planning around these limitations can greatly enhance tax obligation savings, enabling expatriates to maximize their monetary situation while living abroad.

Asserting Real Estate Exemption Benefits

Numerous expatriates overlook the prospective benefits of claiming the Housing Exemption, which can substantially reduce their gross income. This exemption permits people living abroad to deduct particular real estate costs from their gross earnings, making it much easier to meet financial responsibilities without sustaining significant tax obligation liabilities. To maximize this benefit, expatriates ought to verify they certify based on their house and work situations. Additionally, understanding qualified costs-- such as rental fee, energies, and upkeep-- can boost the overall deduction. Maintaining comprehensive records of these prices is crucial for validating insurance claims. By tactically steering through the Real estate Exclusion, expatriates can especially decrease their tax obligation concern and retain even more of their profits while living overseas, inevitably boosting their monetary health.

Use Kind 2555 Efficiently

Using Type 2555 successfully can substantially improve the financial benefits offered to migrants, especially after capitalizing on the Housing Exclusion. This type permits individuals to claim the Foreign Earned Income Exclusion, which can greatly reduce taxable revenue. To make the most of reductions, migrants ought to confirm they satisfy the certifications, consisting of the physical presence test or the bona fide house examination. It is necessary to precisely report all foreign earned income and to maintain extensive records of eligibility. In addition, using the Real estate Exclusion in tandem with Form 2555 can better decrease general tax obligation liability. By recognizing the intricacies of these kinds, migrants can maximize their tax obligation scenario and maintain even more of their hard-earned earnings while living abroad.

Typical Pitfalls to Stay Clear Of When Declaring Your Taxes Abroad

Regularly Asked Inquiries

Can I Declare Both FEIE and the Foreign Tax Debt?

Yes, an individual can assert both the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Obligation Credit Report (FTC) Nonetheless, they need to assure that the exact same revenue is not made use of for both benefits to stay clear of double benefits.

What Takes place if I Go Beyond the FEIE Income Limit?

Going Beyond the Foreign Earned Revenue Exemption (FEIE) earnings limitation results in the ineligibility for the exclusion on the excess amount. This might result in taxed income in the USA, needing ideal tax filings.

Are There Any Kind Of State Tax Obligation Implications for FEIE?

State tax obligation implications for the Foreign Earned Revenue Exemption (FEIE) differ by state. Some states might tire foreign income while others adhere to government exemptions, making it crucial for individuals to seek advice from state-specific tax obligation guidelines for clearness.

How Does FEIE Influence My Social Safety And Security Benefits?

The Foreign Earned Earnings Exclusion (FEIE) does not straight impact Social Safety and security advantages. However, earnings this post excluded under FEIE might affect the computation of ordinary indexed monthly earnings, possibly influencing future benefits.

Can I Withdraw My FEIE Political Election After Claiming It?

Yes, an individual can revoke their International Earned Income Exemption (FEIE) election after asserting it. This retraction must be carried out in creating and sent to the IRS, adhering to certain guidelines and due dates.

Understanding the Foreign Earned Earnings Exemption (FEIE)

The Foreign Earned International Exclusion RevenueExemption) allows U.S. citizens and people aliens working abroad to exclude a portion of section foreign earnings international profits income governmentEarnings Taxpayers earning foreign earnings may still declare the typical deduction, benefiting from reduced taxable earnings also while making use of the Foreign Earned Revenue Exemption (FEIE) Maximizing deductions under the Foreign Earned Earnings Exclusion calls for a clear understanding of gained earnings restrictions and the advantages of declaring real estate exclusions. While lots of migrants look for to minimize their tax obligation worry, comprehending the earned income restrictions is necessary for efficiently leveraging the Foreign Earned Revenue Exclusion. Going Beyond the Foreign Earned Income Exemption (FEIE) revenue restriction results in the ineligibility for the exemption on the excess quantity.